COVID-19 SME Forum

GlobalLinker and Wadhwani Advantage have together partnered with industry experts and leaders to help your business be better prepared

267 week ago — 5 min read

Indian retail industry has more than 15 million traditional and modern retailers. Retail employs ~40-50 million people directly of which modern trade employs more than 6 million Indians equaling to almost 12% of the total retail consumption of the country.

Retail contributes around 40% to India’s consumption and ~10% to India’s GDP.

The lockdown implemented by Government to prevent the spread of COVID-19 to prevent the spread of coronavirus in the country has greatly affected retail business. Most stores, except stores selling essential food & grocery, have been shut across the country. Garments, Saris, Electronics, Mobile Phones, Furniture, Hardware, etc. almost all stores are closed. Non-Grocery/Food Retailers are reporting 80% to 100% reduction in sales. Even retailers of essential items are facing losses as they aren’t allowed to sell non-essential items, which would bring them higher margins.

85% of the retail costs are fixed costs, which is putting several financial pressures on retailers. The industry is experiencing severe liquidity challenges, which can lead to large scale unemployment. The cash inflow of the industry has come to a standstill, while the fixed operating costs remain intact.

85% of the retail costs are fixed costs, which is putting several financial pressures on retailers. The industry is experiencing severe liquidity challenges, which can lead to large scale unemployment.

Concerned by the state of affairs, Retailers Association of India (RAI) conducted a survey with retailers (members and non-members included) to gauge their view on the impact of COVID-19 on their business and manpower. The survey was filled by 768 respondents across India. Two key classifications were made for all the respondents–

Food and Non Food Retailers – 135 (18%) of the respondents were Food Retailers and 633 (82%) were Non Food Retailers

Size of Retailer -

Following were the key highlights of the survey results:

1. Impact on Non-Food Retailers – More than 95% of Non-Food Retailers have their shops closed in the lockdown and are looking at practically no revenues till the lockdown is in place. In the next 6 months, Non - Food Retailers expect to earn 40% as compared to last year’s revenues

2. Impact on Food Retailers – Most of Food Retailers also sell non-essential goods in the same and / or different stores. The non-food business in the stores has come to a standstill in the lockdown leading to revenue loss. Additionally 25% of these retailers have non-food stores which have been closed leading to further losses. In the next 6 months, Food Retailers expect to earn 56% as compared to last year’s revenues.

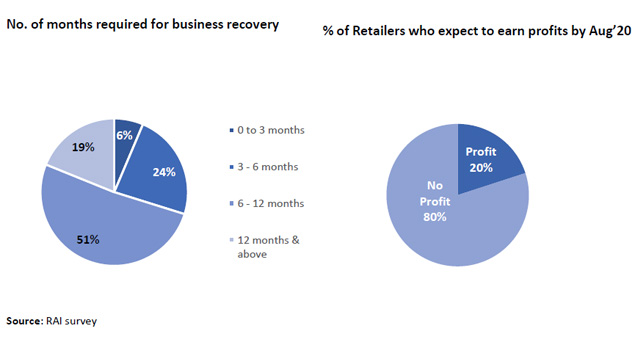

3. Overall Business Outlook – 70% of retailers expect business recovery to happen in more than 6 months, 20% expect it to take more than a year

4. Manpower rationalisation – Small retailers are expecting to lay-off 30% of their manpower going forward, this number falls to 12% for Medium Retailers and 5% for large retailers. On the whole, retailers who responded to the survey expect layoff of about 20% of their manpower.

Key asks from Government:

Also read: An unprecedented challenge, also an opportunity for SMEs to do unprecedented things

Image source: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

COVID-19 SME Forum

GlobalLinker and Wadhwani Advantage have together partnered with industry experts and leaders to help your business be better prepared

The Art & Science of People Pleasing in Retail

23 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion