Employees Provident Fund: What it means & how employers can register for EPF

Legal & Compliance

222 week ago — 9 min read

What is EPF?

The Employees’ Provident Fund, better known as EPF is a welfare scheme that comes under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

The EPF works as a benefits scheme for employees as it makes sure that their life after retirement is financially stable. The scheme takes contributions from both employees and employers. Moreover, at the time of retirement, the employees get to withdraw the amount in their EPF account. Additionally, their EPF accounts will contain their contribution, their employer’s contribution, and interest on both those amounts. Hence, such a scheme is highly helpful to employees working in both private and government-sector jobs.

What is EPFO?

The EPF works as per instructions from the Employees’ Provident Fund Organisation (EPFO). At the time of retirement, the employees get to withdraw the amount in their EPF account. Their EPF accounts will contain their contribution, their employer’s contribution, and the internet on both those amounts. The Employee Provident Fund Organisation thus handles the working of such accounts. The EPFO is one of the world’s most extensive social security and welfare organisations.

Eligibility of EPF Registration for Employers

The following employers and establishments have to mandatorily sign up for the EPF Scheme.

- Initially, any factory employing over 20 people

- Moreover, any establishment which the Central Government specifies, which employs over 20 people

- Additionally, any establishment which the Central Government specifies, even if it has less than 20 employees after giving two months’ notice

- Moreover, any establishment in which the employees and employer decides should register for the EPF, and whose application the Central PF Commissioner approves

- Moreover, any establishment employing less than 20 people who voluntarily sign up for the scheme

- Similarly, companies which have a large workforce must register themselves with the EPFO within a month of employing over 20 people

- Moreover, Co-operative societies which employ over 50 people

- Finally, registered companies can do their EPFO online registration even if their workforce is less than the required 20 people

Documents required for EPF registration for employer

The EPF registration for employers can be done both through online and offline methods. But, before that, a list of documents has to be submitted by the employer depending on the type of entity. As such, the list of documents required for PF registration of employer is as follows:

Proprietorship Firms:

- Name of applicant/employer

- PAN card details

- Valid ID which includes driving license, passport, voter ID card

- Address proof of the place in which the business is being carried out

- Residential address proof

- Phone number

Society/Trust (Co-operatives):

- Incorporation certificate

- Memorandum of Association (MoA)

- PAN card details

- Details of the president of the society and its members

- Address proof

Partnership firms:

- Certificate of registration for the firm

- Deed of partnership

- ID proof of all the partners of the firm – Driving license, passport, voter ID card

- Details of all the partners of the firm

- ID proof and address proofs of the partners

Limited Liability Partnership/ Company:

- Incorporation certificate

- Director’s ID proof

- Director’s Digital Signature Certificate (DSC)

- Details of all the directors

- Address and ID proof of the directors

- Memorandum of Association (MoA) and Articles of Association (AOA)

Other entities:

- Bill of the first sale

- Bill of the first purchase of the machinery and other raw materials

- Bank details namely account number, IFSC code, name, address, and other details

- Monthly strength of employees’ record

- Salary details

- Provident fund (PF) details

- Cross cancelled cheque

As such, according to the type of entity, one must keep the documents required for PF registration of the employer before registering themselves with the EPFO.

EPF registration for employers: The procedure

The EPF registration for employers can be done through simple steps, with the online option being the most preferred and convenient one. Once you have all the documents required for PF registration of the employer, the procedure for online EPF registration for the employer is as follows:

- Visit the official EPFO portal

- On the home page, click on the option of “Establishment Registration”.

- Further, a new page opens up through which you can download the instructions manual for the EPF registration for employers.

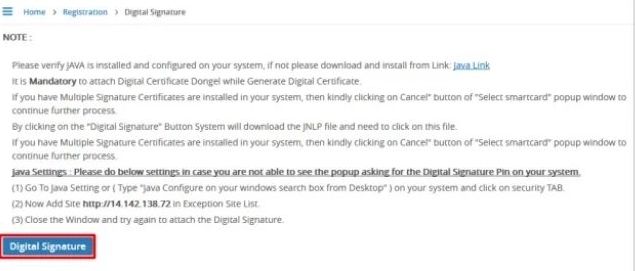

- Before submitting a new application, it is mandatory to get DSC (Digital Signature Certificate) registered, the steps for which are mentioned in the manual for the online EPF registration of the employer.

- On this page, click on the sign-up option. In case, you have already registered, log in using the credentials, i.e., the UAN and password.

- On the sign-up page, enter the name, email and other details accordingly.

- After signing up on this page, click on the option of “Registration for EPFO-ESIC”.

- On the next page that opens up, click on the option of “Apply for New Registration”.

- After clicking on this, you are provided with two options, which include the “Employees’ State Insurance Act” and “Employees Provident Fund and Miscellaneous Provision Act, 1956.”

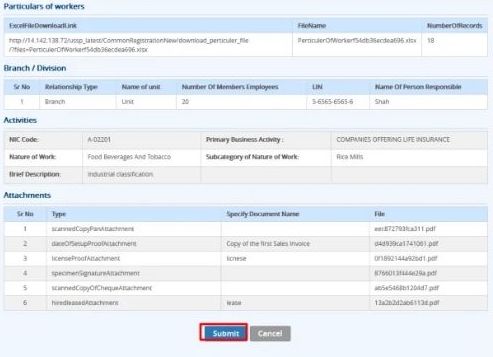

- Choose the suitable option, and click on the “Submit” option.

- Next, a new page opens up, where you are required to fill in all the details for the online EPF registration for the employer. These include:

o Details of establishment

o Employer and employee details

o Identity proofs

o Details related to work and others

- After this, if you want to review the summary of the document, you can check it through the dashboard.

- Further, click on the “Submit” option to complete the registration.

- After this, the Digital Signature Certificate (DSC) of the employer has to be submitted, and its submission is mandatory in the case of a new application.

- After the completion of registration, a confirmation mail is sent to the respective email address.

With the above-mentioned steps and requirements, one can easily complete the online EPF registration for the employer and even the employee. All one needs to do is provide the right set of documents, and get the registration done on time, failing which they will be liable to a penalty.

Things to know about PF online registration

1. PF online contribution is 12% of basic salary, and this is equally paid by both the employer and employee.

2. Additionally, the employer’s contribution is calculated on a salary which includes basic wages, dearness allowance and retaining allowance.

3. In case the establishment employs less than 20 people, the contribution is calculated at 10% of the basic salary.

How to check the balance in your EPF?

- Visit the official website of the EPFO

- Log in to the portal to check the EPFO fund balance

- You can then access your EPF Account passbook

- This webpage contains details regarding your account and the balance in it

Also read: Everything an employer needs to know: PF, ESI, Bonus & Gratuity

To explore business opportunities, link with us by clicking on the 'Connect' button on our eBiz Card.

Image source: shutterstock.com

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Vakilsearch StaffGreetings! We would love to work with you and your company. We look forward to connecting with business houses and MSME's.

Why is it mandatory for an employer to contribute to EPF?

Vakilsearch Staff

Vakilsearch Staff at Vakilsearch

View Vakilsearch 's profile

Other articles written by Vakilsearch Staff

Know About the 4 Types of Partnership Firms

47 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion