Budget 2017: Expectations & aspirations

Economy

438 week ago — 4 min read

It’s that time of the year again - the ‘Budget time’. As everyone hopes for some good news from the Finance Minister in the budget session tomorrow, the excitement is at its peak.

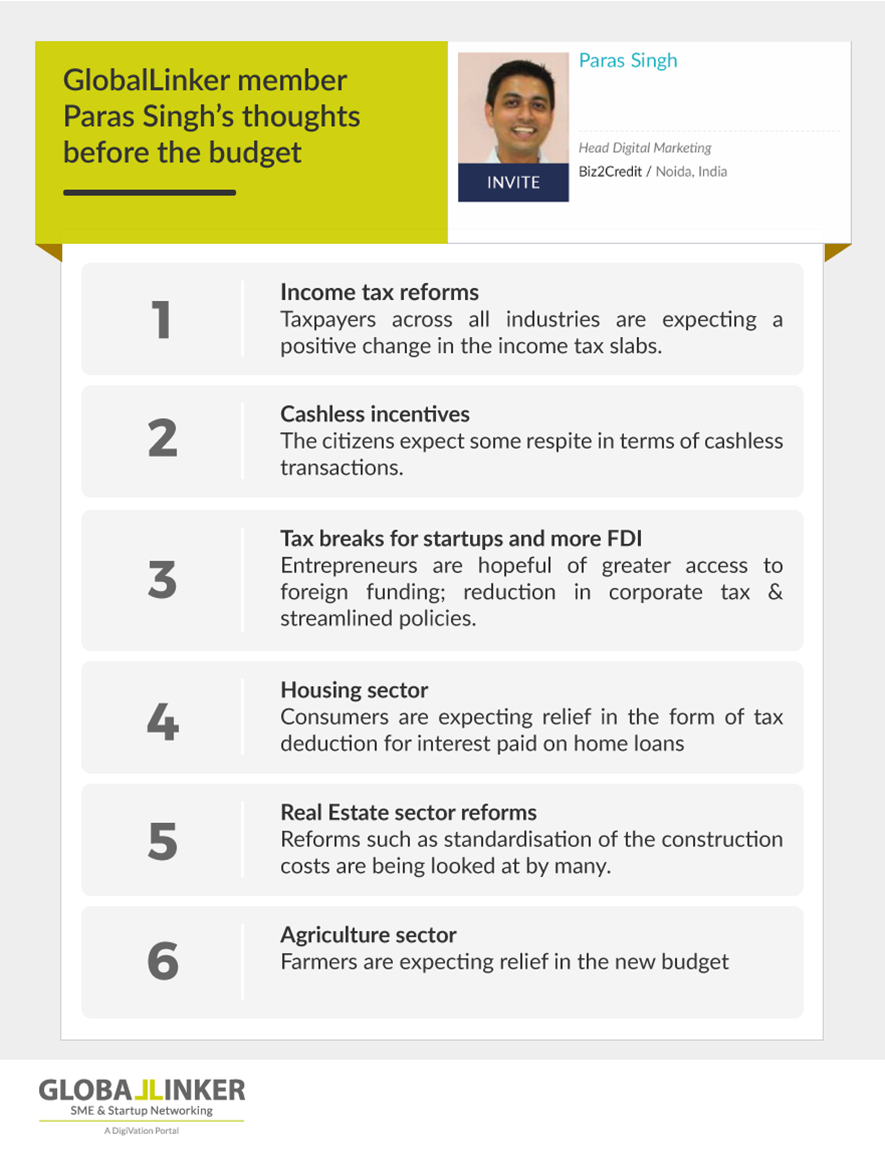

The financial plan announcement has been advanced starting this year, deviating from the standard practice, to complete the tax and expenditure proposals before the start of the new financial year. This policy change is being looked upon as a positive step. Here are 6 important expectations from the current government’s budget:

1. Income tax reforms - Taxpayers across all industries are expecting a positive change in the income tax slabs. Recently, when the Government of India asked people for their suggestions for the upcoming budget, many talked about a revision of income tax slabs. Some said that the basic exemption limit should be raised to INR 5 lakh per year. Also, many suggest that pensioners are expecting complete exclusion from the income tax.

2. Cashless incentives - The citizens expect some respite in terms of cashless transactions. People have voiced their concerns on various platforms regarding discounts or incentives on making debit/ credit card payments, online banking, usage of POS machines by merchants, etc. While many incentives are already in place, benefits for consumers using the above services and banking through payment banks are awaited by many.

3. Tax breaks for startups and more FDI - Since the launch of the Start Up India campaign in January 2016, entrepreneurs have been very hopeful of doing business in the country. Now they are also expecting a better access to foreign funding. Further, they are expecting that the corporate tax applicable to startups will be cut to 25% from the current 30%. Also, they are expecting a more streamlined framework of policies.

4. Housing sector - The union government announced the Pradhan Mantri Awas Yojna (PMAY) in year 2015 to make housing affordable for everyone in India. As a follow up, consumers are expecting a relief in the form of tax deduction for interest paid on home loans. Right now, the upper limit for tax benefits on home loan interest is INR 2 lakh, and a raise in this limit is expected. The increase in tax benefit will make both the taxpayers and as well as industry happy.

5. Real estate sector reforms - As it is, the real estate sector witnessed a lot of turbulence in 2016. The famous note ban only added to their woes. Real Estate Regulatory Act (RERA) and demonetisation, together caused a major slump for all real estate stakeholders, be it the consumers, builders, contractors. Reforms such as standardisation of the construction costs are being looked at by many.

6. Agriculture sector - The farmers were among the worst affected by the note ban, as they were unable to sell their rabi crops on time. The cash crunch hit them and they are expecting some relief in the new budget. The sector looks forward to improved facilities for cashless transactions, ease of making purchases such as seeds, fertilizers, equipment, other farming essentials.

These were a few key expectations from the Union Budget, 2017. Let’s just wait and watch what happens now.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Network with SMEs mentioned in this article

View Paras 's profile

Other articles written by Paras Singh

The impact of GST on industries and consumers

418 week ago

Benefits of getting a pre-approved loan

422 week ago

Most read this week

Comments (1)

Share this content

Please login or Register to join the discussion